Multiple Choice

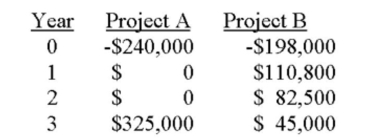

You are considering two mutually exclusive projects with the following cash flows. Will your choice

between the two projects differ if the required rate of return is 8 percent rather than 11 percent? If

so, what should you do?

A) Yes; Select A at 8 percent and B at 11 percent.

B) Yes; Select B at 8 percent and A at 11 percent.

C) Yes; Select A at 8 percent and select neither at 11 percent.

D) No; Regardless of the required rate, project A always has the higher NPV.

E) No; Regardless of the required rate, project B always has the higher NPV.

Correct Answer:

Verified

Correct Answer:

Verified

Q117: A project which has a discounted payback

Q175: Bridgewater Fountains is considering expanding its current

Q176: Matt is analyzing two mutually exclusive projects

Q177: A project will produce cash inflows of

Q180: If a project with conventional cash flows

Q181: The discounted payback rule can be best

Q182: Given that the net present value (NPV)

Q183: An investment's average net income divided by

Q215: The average accounting return calculation takes the

Q322: The internal rate of return (IRR) rule