Multiple Choice

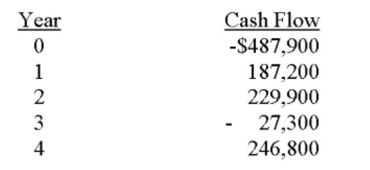

Bridgewater Fountains is considering expanding its current line of business and has developed the following expected cash flows for the project. Should this project be accepted based on the

Discounting approach to the modified internal rate of return if the discount rate is 9.6 percent? Why

Or why not?

A) Yes; The IRR is 9.11 percent.

B) Yes; The IRR is 11.87 percent.

C) Yes; The IRR is 11.99 percent.

D) No; The IRR is 11.87 percent.

E) No; The IRR is 11.99 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q117: A project which has a discounted payback

Q170: A situation in which taking one investment

Q176: Matt is analyzing two mutually exclusive projects

Q177: A project will produce cash inflows of

Q178: You are considering two mutually exclusive projects

Q180: If a project with conventional cash flows

Q215: The average accounting return calculation takes the

Q265: The internal rate of return method of

Q322: The internal rate of return (IRR) rule

Q372: Determining whether to sell bonds or issue