Multiple Choice

Trish earned $1,734.90 during the most recent semimonthly pay period. She is married and has 3 withholding allowances and has no pre-tax deductions. Based on the following table, how much should be withheld from her gross pay for Federal income tax?

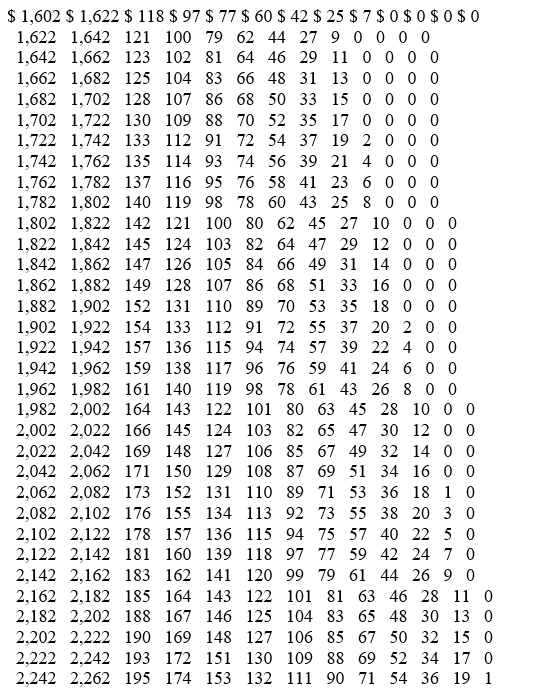

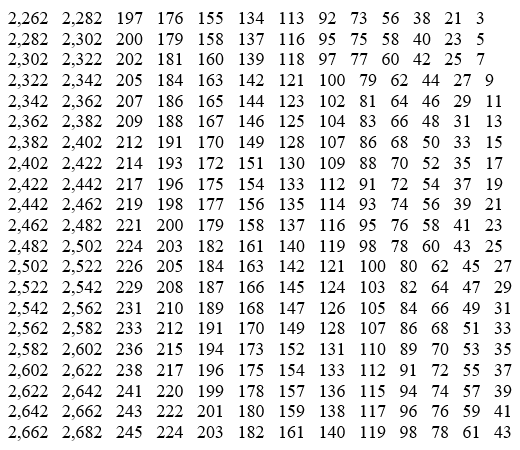

Wage Bracket Method Tables for Income Tax Withholding

MARRIED Persons-SEMIMONTHLY Payroll Period

(For Wages Paid through December 2019)

And the wages are And the number of withholding allowances claimed is-

At least But lessthan 0 1 2 3The amount of income tax to be withheld is-4 5 6 7 8 9 10

A) $72.00

B) $93.00

C) $76.00

D) $95.00

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Charitable contributions are an example of post-tax

Q12: What is a disadvantage to using paycards

Q14: Andie earned $680.20 during the most recent

Q16: Which of the following states do not

Q17: Tierney is a full-time nonexempt salaried employee

Q18: Caroljane earned $1,120 during the most recent

Q19: Which body issued Regulation E to protect

Q20: Melody is a full-time employee in Sioux

Q21: The amount of federal income tax decreases

Q22: Social Security tax has a wage base,