Multiple Choice

Andie earned $680.20 during the most recent weekly pay period. She is single with 3 withholding allowances and needs to decide between contributing 2.5% and $25 to her 401(k) plan. If she chooses the method that results in the lowest taxable income, how much will be withheld for Federal income tax (based on

The following table) ?

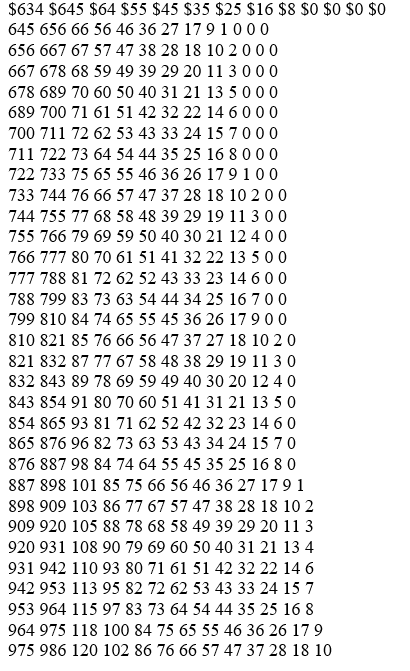

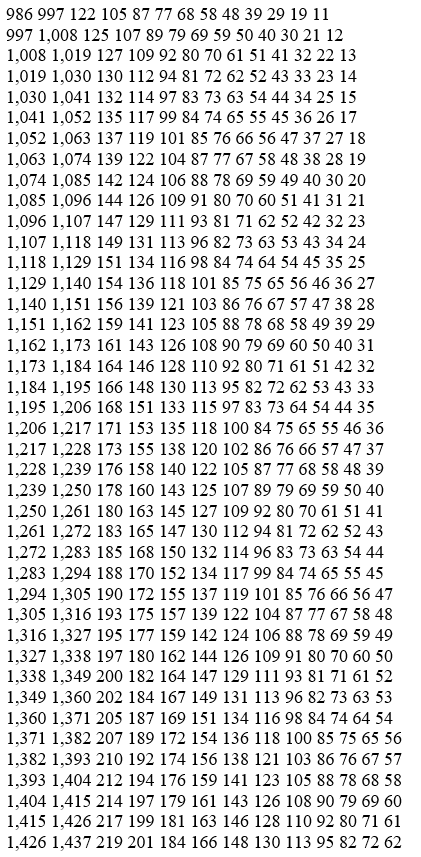

Wage Bracket Method Tables for Income Tax Withholding

SINGLE Persons-WEEKLY Payroll Period

(For Wages Paid through December 2019)

And the wages are And the number of withholding allowances claimed is-

At least But lessthan 0 1 2 3 4 5 6 7 8 9 10

The amount of income tax to be withheld is-

A) $40.00

B) $48.00

C) $36.00

D) $39.00

Correct Answer:

Verified

Correct Answer:

Verified

Q9: The factors that determine an employee's federal

Q10: Charitable contributions are an example of post-tax

Q12: What is a disadvantage to using paycards

Q15: Trish earned $1,734.90 during the most recent

Q16: Which of the following states do not

Q17: Tierney is a full-time nonexempt salaried employee

Q18: Caroljane earned $1,120 during the most recent

Q19: Which body issued Regulation E to protect

Q21: The amount of federal income tax decreases

Q22: Social Security tax has a wage base,