Multiple Choice

Tierney is a full-time nonexempt salaried employee who earns $990 per biweekly pay period. She is single with 1 withholding allowance and both lives and works in Bowling Green, Kentucky. Assuming that she had no overtime, what is the total of her Federal and state taxes for a pay period? (Use the wage-bracket

Tables. Kentucky state income rate is 5.00%. Round final answer to 2 decimal places.)

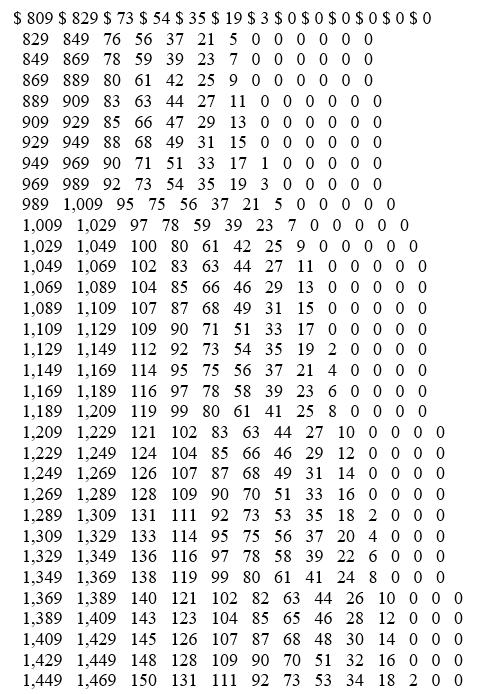

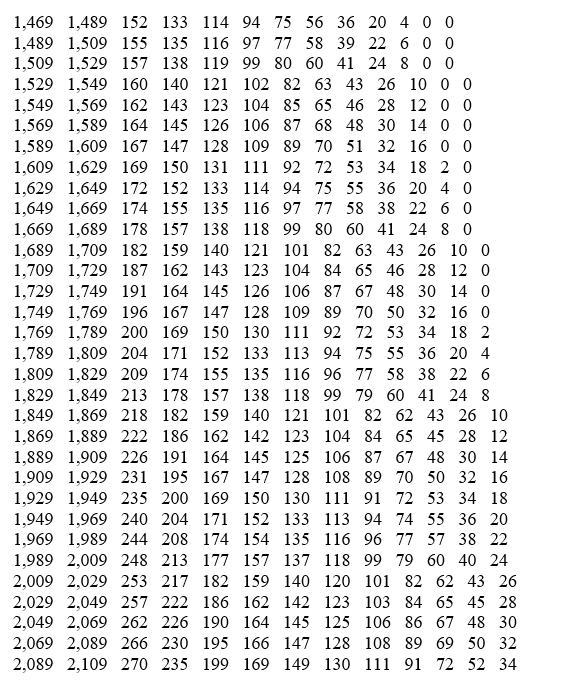

Wage Bracket Method Tables for Income Tax Withholding

SINGLE Persons-BIWEEKLY Payroll Period

(For Wages Paid through December 2019)

And the wages are And the number of withholding allowances claimed is-

At least But lessthan 0 1 2 3The amount of income tax to be withheld is-4 5 6 7 8 9 10

A) $128.25

B) $124.50

C) $120.78

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Charitable contributions are an example of post-tax

Q12: What is a disadvantage to using paycards

Q14: Andie earned $680.20 during the most recent

Q15: Trish earned $1,734.90 during the most recent

Q16: Which of the following states do not

Q18: Caroljane earned $1,120 during the most recent

Q19: Which body issued Regulation E to protect

Q20: Melody is a full-time employee in Sioux

Q21: Collin is a full-time exempt employee in

Q22: Why might an employee elect to have