Multiple Choice

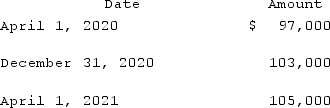

On April 1, 2020, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2021. The dollar value of the loan was as follows:  How much foreign exchange gain or loss should be included in Shannon's 2021 income statement?

How much foreign exchange gain or loss should be included in Shannon's 2021 income statement?

A) $1,000 gain.

B) $1,000 loss.

C) $2,000 gain.

D) $2,000 loss.

E) $8,000 loss.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: A spot rate may be defined as<br>A)

Q37: For speculative derivatives, the change in the

Q70: What is meant by the terms direct

Q72: Potter Corp. (a U.S. company in Colorado)had

Q73: On December 1, 2021, King Co. sold

Q74: Coyote Corp. (a U.S. company in Texas)had

Q75: Woolsey Corporation, a U.S. company, expects to

Q77: To account for a forward contract cash

Q78: On October 1, 2021, Jarvis Co. sold

Q79: On May 1, 2021, Mosby Company received