Essay

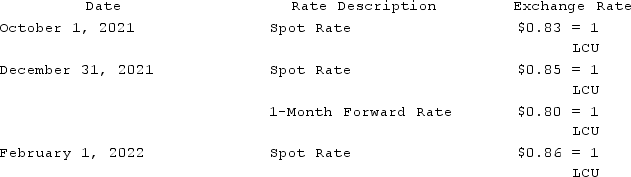

On October 1, 2021, Jarvis Co. sold inventory to a customer in a foreign country, denominated in 100,000 local currency units (LCU). Collection is expected in four months. On October 1, 2021, a forward exchange contract was acquired whereby Jarvis Co. was to pay 100,000 LCU in four months (on February 1, 2022)and receive $78,000 in U.S. dollars. The spot and forward rates for the LCU were as follows:

The company's borrowing rate is 12%. The present value factor for one month is 0.9901.Any discount or premium on the contract is amortized using the straight-line method.Assuming this is a cash flow hedge; prepare journal entries for this sales transaction and forward contract.

The company's borrowing rate is 12%. The present value factor for one month is 0.9901.Any discount or premium on the contract is amortized using the straight-line method.Assuming this is a cash flow hedge; prepare journal entries for this sales transaction and forward contract.

Correct Answer:

Verified

1 [($0.80 − $0.78)10...

1 [($0.80 − $0.78)10...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: Which of the following approaches is used

Q15: A spot rate may be defined as<br>A)

Q37: For speculative derivatives, the change in the

Q70: What is meant by the terms direct

Q73: On December 1, 2021, King Co. sold

Q74: Coyote Corp. (a U.S. company in Texas)had

Q75: Woolsey Corporation, a U.S. company, expects to

Q77: On April 1, 2020, Shannon Company, a

Q77: To account for a forward contract cash

Q79: On May 1, 2021, Mosby Company received