Multiple Choice

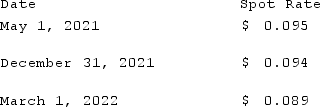

On May 1, 2021, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2022. On May 1, 2021, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2022 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2021. The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the overall result of having entered into this hedge of exposure to foreign exchange risk?

Mosby's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the overall result of having entered into this hedge of exposure to foreign exchange risk?

A) $0.

B) $9,000 net loss on the option.

C) $9,000 net gain on the option.

D) $2,000 net gain on the option.

E) $2,000 net loss.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Which of the following approaches is used

Q15: A spot rate may be defined as<br>A)

Q37: For speculative derivatives, the change in the

Q70: What is meant by the terms direct

Q74: Coyote Corp. (a U.S. company in Texas)had

Q75: Woolsey Corporation, a U.S. company, expects to

Q77: On April 1, 2020, Shannon Company, a

Q77: To account for a forward contract cash

Q78: On October 1, 2021, Jarvis Co. sold

Q84: On October 1, 2021, Eagle Company forecasts