Multiple Choice

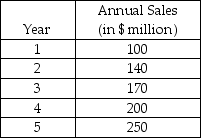

Innovative Inc. is experiencing a boom for the products it has introduced recently. The estimated annual sales projected for the next five years are given in the following table. The current capacity is equivalent to only $100 million sales. The company is considering the alternative of expanding capacity to an equivalent of $250 million sales. Assume a 25 percent pretax profit margin. What is the increase in total pretax cash flow (summed over all years) that would be enjoyed because of the expansion?

A) less than or equal to $40 million

B) more than $40 million but less than or equal to $70 million

C) more than $70 million but less than or equal to $100 million

D) more than $100 million

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The Union Manufacturing Company is producing two

Q4: Scenario 4.5<br>The T. H. King Company has

Q5: _ is the degree to which equipment,

Q6: A standard work year is 2,000 hours

Q7: A company's production facility, consisting of two

Q9: Scenario 4.8<br>The Summerville Vitamin Company manufactures bottles

Q10: The test bank author abandoned his teaching

Q11: If a system is well balanced, which

Q12: What is a capacity cushion? Provide examples

Q13: The lock box department at Bank 21