Essay

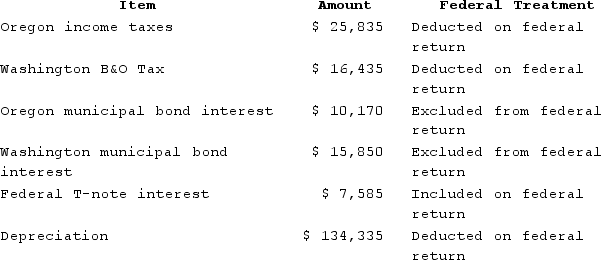

Moss Incorporated is a Washington corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

Moss's Oregon depreciation was $145,585. Moss's federal taxable income was $549,913. Assuming Oregon taxes all municipal bond interest, calculate Moss's Oregon state tax base.

Moss's Oregon depreciation was $145,585. Moss's federal taxable income was $549,913. Assuming Oregon taxes all municipal bond interest, calculate Moss's Oregon state tax base.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Interest and dividends are allocated to the

Q7: Tennis Pro is headquartered in Virginia. Assume

Q9: PWD Incorporated is an Illinois corporation. It

Q10: Gordon operates the Tennis Pro Shop in

Q43: Mighty Manny, Incorporated manufactures ice scrapers and

Q93: The Wayfair decision held that an out-of-state

Q97: Separate-return states require each member of a

Q99: Roxy operates a dress shop in Arlington,

Q114: Which of the following isn't a requirement

Q116: The annual value of rented property is