Multiple Choice

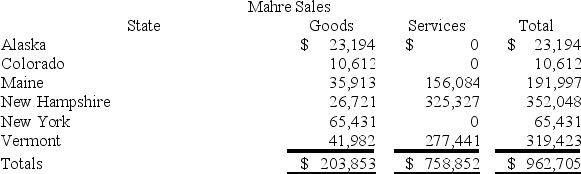

Mahre, Incorporated, a New York corporation, runs ski tours in a several states. Mahre also has a New York retail store and an Internet store which ships to out of state customers. The ski tours operate in Maine, New Hampshire, and Vermont where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:

Assume the following sales tax rates: Alaska (0 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (0 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit?

A) $10,386

B) $14,543

C) $26,733

D) $61,289

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The state tax base is computed by

Q36: Mighty Manny, Incorporated manufactures ice scrapers and

Q37: Gordon operates the Tennis Pro Shop in

Q39: Lefty provides demolition services in several southern

Q41: Mighty Manny, Incorporated manufactures and services deli

Q42: Gordon operates the Tennis Pro Shop in

Q44: Which of the following activities will create

Q58: The payroll factor includes payments to independent

Q89: A gross receipts tax is subject to

Q111: Most services are sourced to the state