Essay

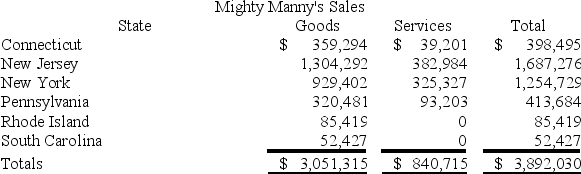

Mighty Manny, Incorporated manufactures and services deli machinery and distributes them across the United States. Mighty Manny is incorporated and headquartered in New Jersey. It has sales tax nexus in Connecticut, New Jersey, New York, Pennsylvania, Rhode Island, and South Carolina. Mighty Manny has sales as follows:

Assume the following sales tax rates: Connecticut (6.75 percent), New Jersey (7.5 percent), New York (8.5 percent), Pennsylvania (6.5 percent), Rhode Island (7.25 percent), and South Carolina (5.5 percent). Assume that Connecticut also taxes Mighty Manny's services. What is Mighty Manny's total sales and use tax liability?

Correct Answer:

Verified

$233,626.

($398,495 × 6.75 per...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

($398,495 × 6.75 per...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: The state tax base is computed by

Q36: Mighty Manny, Incorporated manufactures ice scrapers and

Q37: Gordon operates the Tennis Pro Shop in

Q39: Lefty provides demolition services in several southern

Q40: Mahre, Incorporated, a New York corporation, runs

Q42: Gordon operates the Tennis Pro Shop in

Q44: Which of the following activities will create

Q58: The payroll factor includes payments to independent

Q111: Most services are sourced to the state

Q133: The throwback rule requires a company, for