Multiple Choice

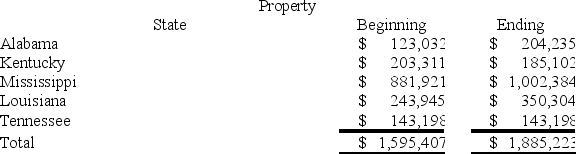

Lefty provides demolition services in several southern states. Lefty has property as follows:

Lefty is a Mississippi Corporation. Lefty also rents property in Mississippi and Tennessee with annual rents of $50,000 and $15,000, respectively. What is Lefty's Mississippi property numerator? (Round your answer to the nearest whole number.)

A) $942,153

B) $1,002,384

C) $1,052,384

D) $1,342,153

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The state tax base is computed by

Q36: Mighty Manny, Incorporated manufactures ice scrapers and

Q37: Gordon operates the Tennis Pro Shop in

Q40: Mahre, Incorporated, a New York corporation, runs

Q41: Mighty Manny, Incorporated manufactures and services deli

Q42: Gordon operates the Tennis Pro Shop in

Q44: Which of the following activities will create

Q89: A gross receipts tax is subject to

Q111: Most services are sourced to the state

Q116: The annual value of rented property is