Multiple Choice

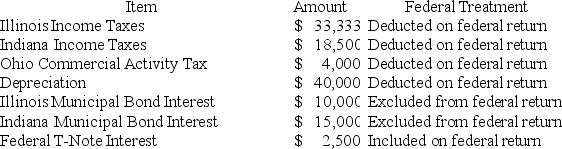

Hoosier Incorporated is an Indiana corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

State depreciation expense was $50,000. Hoosier's Federal Taxable Income was $150,300. Calculate Hoosier's Illinois state tax base.

A) $171,300

B) $173,800

C) $204,633

D) $207,133

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Which of the following law types is

Q28: State tax law is comprised solely of

Q74: The primary purpose of state and local

Q77: Gordon operates the Tennis Pro Shop in

Q79: Moss Incorporated is a Washington corporation. It

Q81: Gordon operates the Tennis Pro Shop in

Q83: Carolina's Hats has the following sales, payroll

Q84: Which of the following businesses is likely

Q85: Gordon operates the Tennis Pro Shop in

Q136: Public Law 86-272 protects certain business activities