Multiple Choice

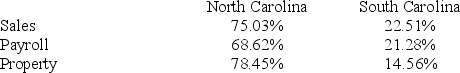

Carolina's Hats has the following sales, payroll and property factors:

What is Carolina's Hats North and South Carolina apportionment factors if North Carolina uses an equally-weighted three-factor formula and South Carolina uses a double-weighted sales factor formula? (Round your answers to two decimal places.)

A) North Carolina 74.03 percent, and South Carolina 19.45 percent.

B) North Carolina 74.03 percent, and South Carolina 20.22 percent.

C) North Carolina 74.28 percent, and South Carolina 19.45 percent.

D) North Carolina 74.28 percent, and South Carolina 22.51 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Federal/state adjustments correct for differences between two

Q28: State tax law is comprised solely of

Q56: Which of the following isn't a typical

Q79: Moss Incorporated is a Washington corporation. It

Q80: Hoosier Incorporated is an Indiana corporation. It

Q81: Gordon operates the Tennis Pro Shop in

Q84: Which of the following businesses is likely

Q85: Gordon operates the Tennis Pro Shop in

Q131: Which of the following is not a

Q136: Public Law 86-272 protects certain business activities