Essay

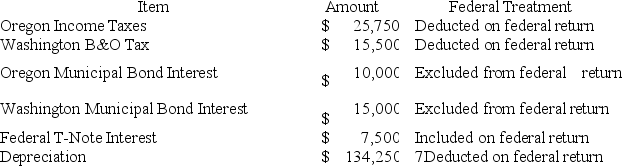

Moss Incorporated is a Washington corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

Moss' Oregon depreciation was $145,500. Moss' Federal Taxable Income was $549,743. Calculate Moss' Oregon state tax base.

Correct Answer:

Verified

$571,743.

$549,743 +...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$549,743 +...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Which of the following law types is

Q28: State tax law is comprised solely of

Q74: The primary purpose of state and local

Q74: Gordon operates the Tennis Pro Shop in

Q77: Gordon operates the Tennis Pro Shop in

Q80: Hoosier Incorporated is an Indiana corporation. It

Q81: Gordon operates the Tennis Pro Shop in

Q83: Carolina's Hats has the following sales, payroll

Q84: Which of the following businesses is likely

Q136: Public Law 86-272 protects certain business activities