Given the Following Information on Three Stocks = -05333

Bc

Now Suppose You Diversify into Two Securities

Essay

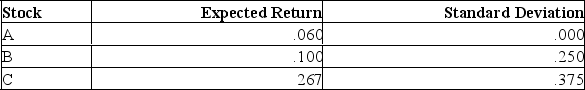

Given the following information on three stocks:

= -.05333

= -.05333

bc

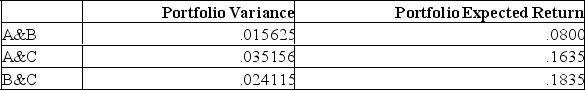

Now suppose you diversify into two securities. Given all choices, can any portfolio be eliminated? Assume equal weights.

Correct Answer:

Verified

Portfolio ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Draw the SML and plot asset C

Q33: Beta measures:<br>A) the ability to diversify risk.<br>B)

Q35: If the correlation between two stocks is

Q36: A portfolio will usually contain:<br>A) only one

Q37: The separation principle states that an investor

Q40: Stock A has an expected return of

Q41: Idaho Slopes (IS) and Dakota Steppes (DS)

Q42: Returns for the IC Company and for

Q43: Given the following information on 3 stocks:<br>

Q84: An efficient set of portfolios is:<br>A) the