Essay

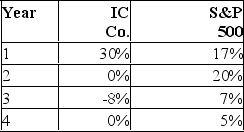

Returns for the IC Company and for the S&P 500 Index over the previous 4-year period are given below:

What are the average returns on IC and on the S&P 500 index? If you had invested $1.00 in IC, how much would you have had after 4 years? What is the correlation between the returns on IC and the S&P?

What are the average returns on IC and on the S&P 500 index? If you had invested $1.00 in IC, how much would you have had after 4 years? What is the correlation between the returns on IC and the S&P?

Correct Answer:

Verified

Average return is 22/4 = 5.5% for IC and...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Draw the SML and plot asset C

Q37: The separation principle states that an investor

Q38: Given the following information on three

Q40: Stock A has an expected return of

Q41: Idaho Slopes (IS) and Dakota Steppes (DS)

Q43: Given the following information on 3 stocks:<br>

Q44: Idaho Slopes (IS) and Dakota Steppes (DS)

Q45: A portfolio contains four assets. Asset 1

Q46: The combination of the efficient set of

Q47: Which one of the following would indicate