Essay

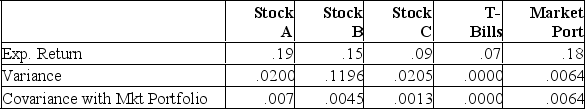

Given the following information on 3 stocks:

Using the CAPM, calculate the expected return for Stock's A, B, and

Using the CAPM, calculate the expected return for Stock's A, B, and

C. Which stocks would you recommend purchasing?

BA = .0070/.0064 = 1.094; ra = .07 + (.18-.07)1.094 = .1903

BB = .0045/.0064 = 0.703; rb = .07 + (.18-.07)0.703 = .1473

BC = .0013/.0064 = 0.203; rc = .07 + (.18-.07)0.203 = .0923

Indifferent on A as .1903 _.19.

Would buy B as.15 > .1473.

Would not buy C as.09 < .0923.

Correct Answer:

Verified

BA = .0070/.0064 = 1.094; ra = .07 + (.1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Draw the SML and plot asset C

Q38: Given the following information on three

Q40: Stock A has an expected return of

Q41: Idaho Slopes (IS) and Dakota Steppes (DS)

Q42: Returns for the IC Company and for

Q44: Idaho Slopes (IS) and Dakota Steppes (DS)

Q45: A portfolio contains four assets. Asset 1

Q46: The combination of the efficient set of

Q47: Which one of the following would indicate

Q48: Standard deviation measures _ risk.<br>A) total<br>B) nondiversifiable<br>C)