Multiple Choice

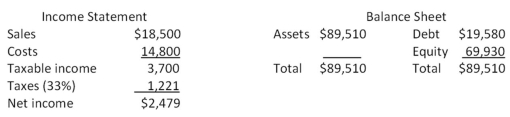

The most recent financial statements for Last in Line, Inc.are shown here:  Assets and costs are proportional to sales.Debt and equity are not.A dividend of $992 was paid, and the company wishes to maintain a constant payout ratio.Next year's sales are projected to be $21,830.What is the amount of the external financing need?

Assets and costs are proportional to sales.Debt and equity are not.A dividend of $992 was paid, and the company wishes to maintain a constant payout ratio.Next year's sales are projected to be $21,830.What is the amount of the external financing need?

A) $12,711

B) $13,333

C) $13,556

D) $13,809

E) $14,357

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Financial plans generally tend to ignore which

Q32: Miller Bros.Hardware is operating at full capacity

Q36: Gladsden Refinishers currently has $21,900 in sales

Q52: The Parodies Corp.has a 22 percent return

Q53: A pro forma statement indicates that both

Q63: A firm has a retention ratio of

Q91: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg" alt=" Hungry

Q93: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg" alt=" Assume

Q97: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg" alt=" The

Q98: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg" alt=" Fake