Multiple Choice

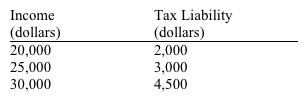

Use the table below to choose the correct answer.  The marginal tax rate on income in the $20,000 to $25,000 range is

The marginal tax rate on income in the $20,000 to $25,000 range is

A) 10 percent.

B) 12 percent.

C) 20 percent.

D) 30 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q98: Figure 4-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 4-22

Q100: Figure 4-24 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 4-24

Q101: Use the figure below to answer the

Q103: Figure 4-23 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 4-23

Q106: Figure 4-17 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 4-17

Q146: The burden of a tax will fall

Q162: The actual incidence (or burden) of a

Q185: When a government subsidy is granted to

Q238: Which tax rate measures the percent of

Q239: A subsidy on a product will generate