Multiple Choice

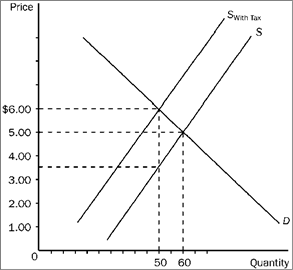

Figure 4-22  Refer to Figure 4-22. Suppose the same S and D curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the buyers of the good, rather than the sellers, are required to pay the tax to the government. Now,

Refer to Figure 4-22. Suppose the same S and D curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the buyers of the good, rather than the sellers, are required to pay the tax to the government. Now,

A) the burden on buyers will be larger than in the case illustrated in Figure 4-22.

B) the burden on sellers will be smaller than in the case illustrated in Figure 4-22.

C) a downward shift of the demand curve replaces the upward shift of the supply curve.

D) All of the above are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q56: A law establishing a minimum legal price

Q93: Figure 4-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 4-22

Q100: Figure 4-24 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 4-24

Q101: Use the figure below to answer the

Q102: Use the table below to choose the

Q103: Figure 4-23 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 4-23

Q105: If a $500 tax is placed legally

Q162: The actual incidence (or burden) of a

Q178: When a government subsidy is granted to

Q239: A subsidy on a product will generate