Essay

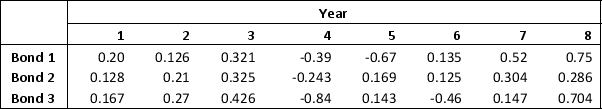

Consider the following data on the returns from bonds:

Develop and solve the Markowitz portfolio model using a required expected return of at least 15 percent. Assume that the 8 scenarios are equally likely to occur. Use this model to construct an efficient frontier by varying the expected return from 2 to 18 percent in increment of 2 percent and solving for the variance. Round all your answers to three decimal places.

Develop and solve the Markowitz portfolio model using a required expected return of at least 15 percent. Assume that the 8 scenarios are equally likely to occur. Use this model to construct an efficient frontier by varying the expected return from 2 to 18 percent in increment of 2 percent and solving for the variance. Round all your answers to three decimal places.

Correct Answer:

Verified

a. Let X = the fraction of the...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Excel Solver's _ is based on a

Q17: A _ is the shadow price of

Q36: A portfolio optimization model used to construct

Q41: Solving nonlinear problems with local optimal solutions

Q43: A feasible solution is a local minimum

Q51: Consider the EOQ model for multiple products

Q52: An Electrical Company has two manufacturing plants.

Q53: Develop a model that minimizes semivariance for

Q56: Which of the following conclusions can be

Q60: Consider the data on investment made in