Essay

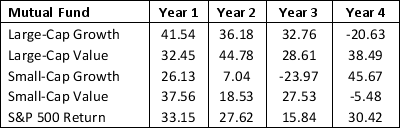

Consider the data on investment made in four types of funds and returns from S&P 500.

a. Develop an optimization model that will give the fraction of the portfolio to invest in each of the funds so that the return of the resulting portfolio matches as closely as possible the return of the S&P 500 Index. (Hint: Minimize the sum of the squared deviations between the portfolio's return and the S&P 500 Index return for each year in the data set.)

a. Develop an optimization model that will give the fraction of the portfolio to invest in each of the funds so that the return of the resulting portfolio matches as closely as possible the return of the S&P 500 Index. (Hint: Minimize the sum of the squared deviations between the portfolio's return and the S&P 500 Index return for each year in the data set.)

b. Solve the model developed in part a.

Correct Answer:

Verified

a. Let

LG = proportion of portfolio inve...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

LG = proportion of portfolio inve...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Excel Solver's _ is based on a

Q17: A _ is the shadow price of

Q36: A portfolio optimization model used to construct

Q41: Solving nonlinear problems with local optimal solutions

Q43: A feasible solution is a local minimum

Q51: Consider the EOQ model for multiple products

Q52: An Electrical Company has two manufacturing plants.

Q53: Develop a model that minimizes semivariance for

Q55: Consider the following data on the returns

Q56: Which of the following conclusions can be