Short Answer

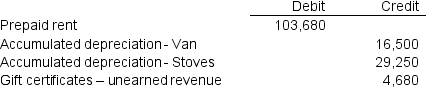

Select accounts of Burger Express are shown below as of December 31, 2017, before any accounts have been adjusted for the current fiscal year.

Your analysis reveals additional information as follows:

Your analysis reveals additional information as follows:

On June 1, 2017, the company prepaid rent of $8,640 per month for a 12-month lease on its building.

The company bought the van on January 1, 2015 for the cost of $132,000. The van is expected to last eight years. The company's policy is to record depreciation evenly over the asset's useful life. No depreciation has been recorded during fiscal year 2017.

When purchased on January 1, 2014, the stoves had expected lives of 10 years. The company's policy is to record depreciation evenly over the asset's useful life. No depreciation has been recorded on the stoves during fiscal 2017.

The company sells numbered gift certificates in $60 denominations. At year-end there were 30 unredeemed gift certificates.

Prepare journal entries for any required accounting adjustments.

Correct Answer:

Verified

To record rent expense for seven months...

To record rent expense for seven months...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q51: Expenses that are paid in advance are

Q52: Examine the financial statements effects template below.

Q53: During the year ended December 31, 2016,

Q54: During the year ended December 31, 2016,

Q55: The January 28, 2017 income statement and

Q56: Maibrit's Bike's began operations in April 2017

Q57: Revenues and expenses affect the income statement

Q58: Which of the following accounts would not

Q59: Prepare journal entries to record the following

Q60: The December 28, 2016 income statement of