Multiple Choice

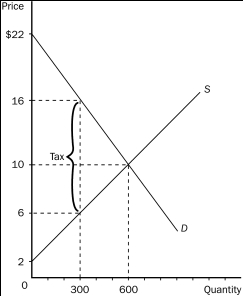

Figure 8-5

-Refer to Figure 8-5.When a tax is imposed in this market,the price buyers effectively pay is

A) $10.

B) $16.

C) $22.

D) between $10 and $16.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: Suppose a tax of $1 per unit

Q14: Figure 8-7 The graph below represents a

Q15: Taxes<br>A)distort incentives and this distortion causes markets

Q20: When Ronald Reagan ran for the presidency

Q23: Use the following graph shown to fill

Q24: One negative aspect of Henry George's single

Q25: Consider a good to which a per-unit

Q77: A tax levied on the sellers of

Q193: Suppose the tax on gasoline is raised

Q203: Because taxes distort incentives, they cause markets