Multiple Choice

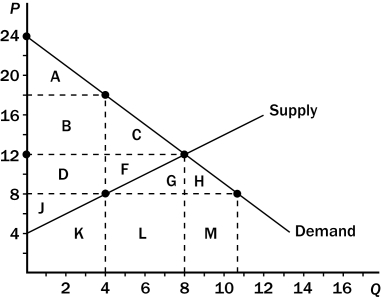

Figure 8-7 The graph below represents a $10 per unit tax on a good. On the graph, Q represents quantity and P represents price.

-Refer to Figure 8-7.After the tax goes into effect,consumer surplus is the area

A) a.

B) B + C.

C) A + B + C.

D) A + B + D + J + K.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: The amount of deadweight loss that results

Q10: Figure 8-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2178/.jpg" alt="Figure 8-1

Q11: Figure 8-4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2178/.jpg" alt="Figure 8-4

Q12: Figure 8-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2178/.jpg" alt="Figure 8-5

Q13: The supply curve and the demand curve

Q13: Suppose a tax of $1 per unit

Q15: Taxes<br>A)distort incentives and this distortion causes markets

Q19: Figure 8-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2178/.jpg" alt="Figure 8-5

Q77: A tax levied on the sellers of

Q193: Suppose the tax on gasoline is raised