Multiple Choice

Figure 8-5

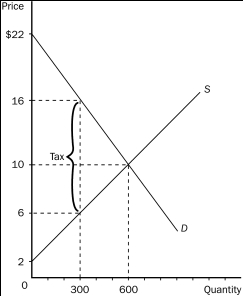

-Refer to Figure 8-5.When a tax is imposed in this market,consumer surplus is

A) $600.

B) $900.

C) $1,500.

D) $3,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Figure 8-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2178/.jpg" alt="Figure 8-5

Q8: Figure 8-6<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2178/.jpg" alt="Figure 8-6

Q9: The amount of deadweight loss that results

Q10: Figure 8-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2178/.jpg" alt="Figure 8-1

Q11: Figure 8-4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2178/.jpg" alt="Figure 8-4

Q13: The supply curve and the demand curve

Q14: Figure 8-7 The graph below represents a

Q15: Taxes<br>A)distort incentives and this distortion causes markets

Q77: A tax levied on the sellers of

Q193: Suppose the tax on gasoline is raised