Essay

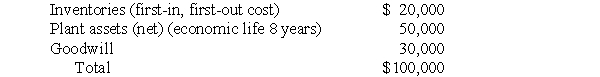

On July 1, 2005, Parson Corporation acquired all the outstanding common stock of Scate Company for $900,000. On that date, the carrying amount of Scate's identifiable net assets was $800,000. The difference of $100,000 was allocated as follows:

Scate had a net income of $190,000 and declared dividends of $100,000 for the fiscal year ended June 30, 2006. Scate uses straight-line depreciation for plant assets. Goodwill was one-thirtieth impaired on June 30, 2006.

Scate had a net income of $190,000 and declared dividends of $100,000 for the fiscal year ended June 30, 2006. Scate uses straight-line depreciation for plant assets. Goodwill was one-thirtieth impaired on June 30, 2006.

Prepare a working paper to compute the following for Parson Corporation under the equity method of accounting (disregard income taxes):

a. Balance of Intercompany Investment Income ledger account on June 30, 2006

b. Balance of Investment in Scate Company Common Stock ledger account on June 30, 2006

Correct Answer:

Verified

Correct Answer:

Verified

Q29: Proponents of the equity method of accounting

Q30: Under the equity method of accounting, the

Q31: On September 30, 2005, Phoenix Corporation paid

Q32: If a wholly owned subsidiary's net income

Q33: Plover Corporation accounts for its 80%-owned purchased

Q34: Use of the equity method of accounting

Q35: The format of a parent company's journal

Q36: For the fiscal year ended March 31,

Q37: A parent company that uses the equity

Q38: In a closing entry for a parent