Essay

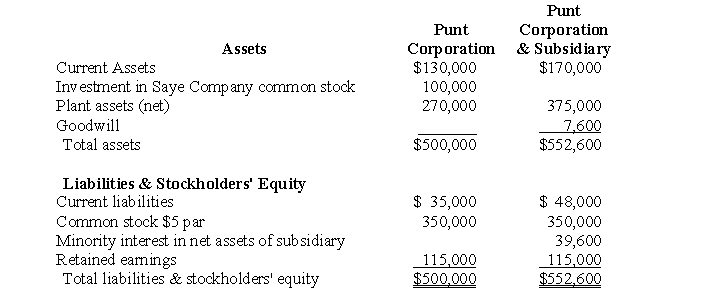

Punt Corporation acquired a controlling interest in Saye Company for cash. The separate balance sheet of Punt and the consolidated balance sheet immediately after the business combination were as follows:

Plant assets of Saye Company were undervalued by $15,000 on the date of the business combination; the remainder of Punt's cost was assigned to goodwill. The retained earnings of Saye on the date of the business combination amounted to $37,000.

Plant assets of Saye Company were undervalued by $15,000 on the date of the business combination; the remainder of Punt's cost was assigned to goodwill. The retained earnings of Saye on the date of the business combination amounted to $37,000.

a. Prepare the separate balance sheet of Saye Company on the date of the business combination.

b. What percentage of the common stock of Saye was acquired by Punt?

c. Prepare the working paper elimination (in journal entry format) for Punt Corporation and subsidiary on the date of the business combination.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: On June 30, 2006, Purdom Corporation acquired

Q3: Goodwill recognized in a business combination of

Q4: Only the balance sheet is consolidated on

Q5: On May 31, 2006, Ping Corporation paid

Q6: On March 31, 2006, Preston Corporation acquired

Q7: In a business combination resulting in a

Q8: Under the<B> parent company concept </B>of consolidated

Q9: A parent company's journal entries to record

Q10: On October 31, 2006, Portugal Corporation acquired

Q11: In a business combination that establishes a