Multiple Choice

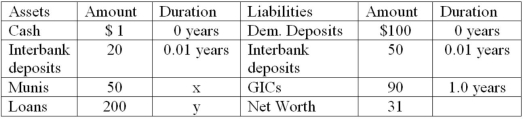

The following is an FI's balance sheet ($millions) .  Notes to Balance Sheet: Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. GICs are 1-year pure discount certificates of deposit paying 4.75 percent.

Notes to Balance Sheet: Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. GICs are 1-year pure discount certificates of deposit paying 4.75 percent.

What is this bank's interest rate risk exposure, if any?

A) The bank is exposed to decreasing interest rates because it has a negative duration gap of -0.21 years.

B) The bank is exposed to increasing interest rates because it has a negative duration gap of -0.21 years.

C) The bank is exposed to increasing interest rates because it has a positive duration gap of +0.21 years.

D) The bank is exposed to decreasing interest rates because it has a positive duration gap of +0.21 years.

E) The bank is not exposed to interest rate changes since it is running a matched book.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: The value for duration describes the percentage

Q9: Third Duration Investments has the following assets

Q10: The following information is about current spot

Q25: All fixed-income assets exhibit convexity in their

Q65: Matching the maturities of assets and liabilities

Q70: An FI purchases at par value a

Q73: Convexity is a desirable effect to a

Q83: Duration of a fixed-rate coupon bond will

Q93: The cost in terms of both time

Q115: Buying a fixed-rate asset whose duration is