Not Answered

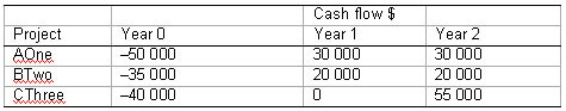

The following three investments projects are independent.If the required rate of return is 12% p.a. ,which projects are acceptable using both the NPV and IRR methods?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q35: Benefit-cost ratio is also known as:<br>A)benefit-cost index.<br>B)total

Q36: The net present value for a project

Q37: What should the project manager do if

Q38: A necessary condition for multiple internal rates

Q39: Which of the following statements is true?<br>A)The

Q41: Economic value added is the most widely

Q42: A weakness of the payback method of

Q43: The benefit-cost ratio is calculated by dividing

Q44: Project K has a cost of $52

Q45: Which of the following statements is false?<br>A)Accepting