Multiple Choice

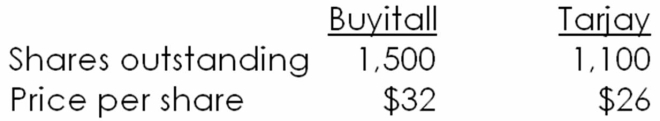

Consider the following premerger information about a bidding firm (Buyitall Inc.) and a target firm (Tarjay Corp.) .Assume that neither firm has any debt outstanding.  Buyitall has estimated that the present value of any enhancements that Buyitall expects from acquiring Tarjay is $2,600.What is the NPV of the merger assuming that Tarjay is willing to be acquired for $28 per share in cash?

Buyitall has estimated that the present value of any enhancements that Buyitall expects from acquiring Tarjay is $2,600.What is the NPV of the merger assuming that Tarjay is willing to be acquired for $28 per share in cash?

A) $400

B) $600

C) $1,800

D) $2,200

E) $2,600

F) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Ginormous Oil entered into an agreement to

Q7: Assume that at year-end 2015 the company's

Q8: The following table presents a four-year forecast

Q9: The following table presents a four-year forecast

Q10: Estimate BSL's value (in $ millions)at the

Q12: Ginormous Oil entered into an agreement to

Q13: Estimate BSL's value (in $ millions)at the

Q14: The following information is available about Chiantivino

Q15: Ametek,Inc.is a billion dollar manufacturer of electronic

Q16: Below is a recent income statement for