Essay

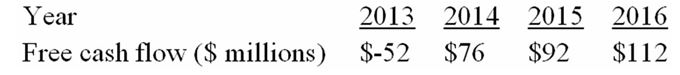

The following table presents a four-year forecast for Kenmore Air, Inc.:

-Estimate the fair market value per share of Kenmore Air's equity at the end of 2016 if the company has 40 million shares outstanding and the market value of its interest-bearing liabilities on the valuation date equals $250 million.

Correct Answer:

Verified

FMV = PV{FCF,2013 - 16} + PV{Terminal va...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Which of the following statements are correct?<br>I.Liquidation

Q4: Assume that in the years after 2015

Q5: Estimate BSL's value (in $ millions)at the

Q6: Ginormous Oil entered into an agreement to

Q7: Assume that at year-end 2015 the company's

Q9: The following table presents a four-year forecast

Q10: Estimate BSL's value (in $ millions)at the

Q11: Consider the following premerger information about a

Q12: Ginormous Oil entered into an agreement to

Q13: Estimate BSL's value (in $ millions)at the