Essay

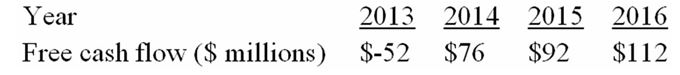

The following table presents a four-year forecast for Kenmore Air, Inc.:

-Estimate the fair market value of Kenmore Air's equity per share at the end of 2012 under the following assumptions:

a.EBIT in year 2016 will be $200 million.

b.At year-end 2016,Kenmore Air has reached maturity,and analysts expect its equity will sell for 12 times year 2016 net income.

c.At year-end 2016,Kenmore Air has $250 million of interest-bearing liabilities outstanding at an average interest rate of 10 percent.

Correct Answer:

Verified

FMV = PV{FCF,2013 - 16} + PV{Terminal va...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Assume that in the years after 2015

Q5: Estimate BSL's value (in $ millions)at the

Q6: Ginormous Oil entered into an agreement to

Q7: Assume that at year-end 2015 the company's

Q8: The following table presents a four-year forecast

Q10: Estimate BSL's value (in $ millions)at the

Q11: Consider the following premerger information about a

Q12: Ginormous Oil entered into an agreement to

Q13: Estimate BSL's value (in $ millions)at the

Q14: The following information is available about Chiantivino