Multiple Choice

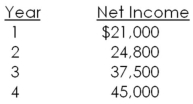

An investment has an initial cost of $420,000 and will generate the net income amounts shown below.This investment will be depreciated straight-line to zero over the four-year life of the project.Should this project be accepted based on the average accounting rate of return if the required rate is 16 percent? Why or why not?

A) Yes, because the AAR is equal to 16 percent

B) Yes, because the AAR is greater than 16 percent

C) Yes, because the AAR is less than 16 percent

D) No, because the AAR is greater than 16 percent

E) No, because the AAR is less than 16 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Explain why the net present value is

Q3: Payback is best used to evaluate which

Q4: Chasteen,Inc.is considering an investment with an initial

Q5: Which one of the following defines the

Q6: What is the net present value of

Q7: The modified internal rate of return is

Q8: The internal rate of return is unreliable

Q9: Quattro,Inc.has the following mutually exclusive projects available.The

Q11: Delta Mu Delta is considering purchasing some

Q90: The average accounting return:<br>A)measures profitability rather than