Multiple Choice

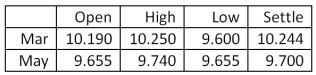

You are a jewelry maker. In May of each year, you purchase 10,000 troy ounces of silver to restock your production inventory. Today, you hedged your position at what turned out to be the lowest price of the day. Assume the actual price per troy ounce of silver is 9.215 in May. How much did you gain or lose by hedging your position?

Silver - 5,000 troy oz.:

u.S. dollars and cents per troy oz.

A) loss $4,400

B) loss $2,200

C) no gain or loss

D) gain $2,200

E) gain $4,400

Correct Answer:

Verified

Correct Answer:

Verified

Q3: You own three January futures contracts on

Q8: Suppose you purchase the November call option

Q9: What was the highest price per troy

Q10: Suppose your firm produces breakfast cereal and

Q14: Which one of the following obligates you

Q18: A hedge between which two of the

Q35: Which one of the following is true

Q52: Long-run financial risk:<br>A) can frequently be hedged

Q57: Farmer Ted planted 200 acres in wheat

Q65: Interest rate swaps:<br>I.benefit either the buyer or