Multiple Choice

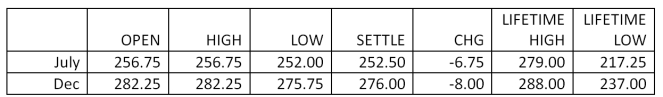

Suppose your firm produces breakfast cereal and needs 65,000 bushels of corn in December for an upcoming promotion. You would like to lock in your costs today because you are concerned that corn prices might go up between now and December. To hedge your risk exposure, you could purchase corn futures contracts today effectively locking in a total settlement price of _____, based on the closing price shown in the table below. Futures:

Corn - 5,000 bu., U.S. cents per bu.

A) $163,800

B) $164,125

C) $174,238

D) $179,400

E) $183,463

Correct Answer:

Verified

Correct Answer:

Verified

Q5: You are a jewelry maker. In May

Q8: Suppose you purchase the November call option

Q9: What was the highest price per troy

Q12: Suppose a financial manager buys call options

Q14: You are the buyer for a cereal

Q31: Which of the following are futures exchanges?<br>I.New

Q51: Southern Groves raises tangerines. To hedge its

Q52: Long-run financial risk:<br>A) can frequently be hedged

Q57: Farmer Ted planted 200 acres in wheat

Q65: Interest rate swaps:<br>I.benefit either the buyer or