Multiple Choice

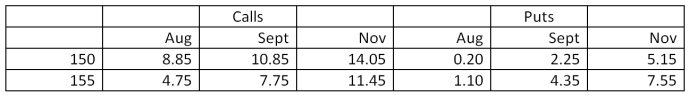

Suppose you purchase the November call option on orange juice futures with a strike price of 150 at the price shown in the table below. What will be your profit or loss on this contract if the price of orange juice futures is $0.616 per pound at expiration of the option contract?

Futures Options

Orange juice:

15,000 lbs, U.S. cents per lb.

A) loss of $2,107.50

B) loss of $1,717.50

C) no profit or loss

D) profit of $1,717.50

E) profit of $2,107.50

Correct Answer:

Verified

Correct Answer:

Verified

Q3: You own three January futures contracts on

Q5: You are a jewelry maker. In May

Q9: What was the highest price per troy

Q10: Suppose your firm produces breakfast cereal and

Q12: Suppose a financial manager buys call options

Q31: Which of the following are futures exchanges?<br>I.New

Q35: Which one of the following is true

Q52: Long-run financial risk:<br>A) can frequently be hedged

Q57: Farmer Ted planted 200 acres in wheat

Q65: Interest rate swaps:<br>I.benefit either the buyer or