Multiple Choice

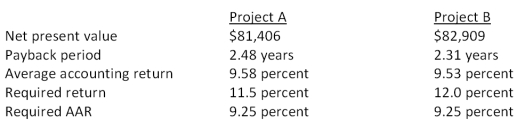

Isaac has analyzed two mutually exclusive projects of similar size and has compiled the following information based on his analysis. Both projects have 3- year lives.  Isaac has been asked for his best recommendation given this information. His recommendation should be to accept:

Isaac has been asked for his best recommendation given this information. His recommendation should be to accept:

A) both projects.

B) project B because it has the shortest payback period.

C) project B and reject project A based on their net present values.

D) project A and reject project B based on their average accounting returns.

E) neither project.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Applying the discounted payback decision rule to

Q27: Which two methods of project analysis were

Q48: Which two methods of project analysis are

Q50: How does the net present value (NPV)decision

Q52: The internal rate of return is: <br>A) the

Q67: Which of the following are considered weaknesses

Q98: You are considering the following two mutually

Q100: Boston Chicken is considering two mutually exclusive

Q104: You are considering the following two mutually

Q106: A firm evaluates all of its projects