Multiple Choice

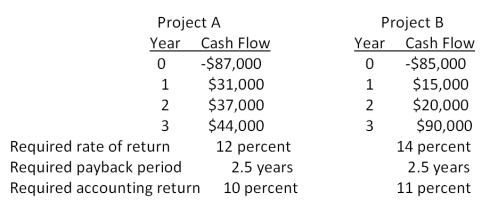

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.  Should you accept or reject these projects based on net present value analysis?

Should you accept or reject these projects based on net present value analysis?

A) accept Project A and reject Project B

B) reject Project A and accept Project B

C) accept both Projects A and B

D) reject both Projects A and B

E) You cannot make this decision based on net present value analysis.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Applying the discounted payback decision rule to

Q27: Which two methods of project analysis were

Q50: How does the net present value (NPV)decision

Q52: The internal rate of return is: <br>A) the

Q67: Which of the following are considered weaknesses

Q100: Boston Chicken is considering two mutually exclusive

Q102: Isaac has analyzed two mutually exclusive projects

Q106: A firm evaluates all of its projects

Q108: Cool Water Drinks is considering a proposed

Q109: Hungry Hoagie's has identified the following two