Multiple Choice

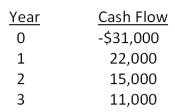

A firm evaluates all of its projects by using the NPV decision rule. At a required return of 14 percent, the NPV for the following project is _____ and the firm should _____ the project.

A) $5,684.22; reject

B) $7,264.95; accept

C) $7,264.95; reject

D) $9,616.93; accept

E) $9,616.93; reject

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Applying the discounted payback decision rule to

Q50: How does the net present value (NPV)decision

Q52: The internal rate of return is: <br>A) the

Q66: Which one of the following statements would

Q67: Which of the following are considered weaknesses

Q81: J&J Enterprises is considering an investment that

Q102: Isaac has analyzed two mutually exclusive projects

Q104: You are considering the following two mutually

Q108: Cool Water Drinks is considering a proposed

Q109: Hungry Hoagie's has identified the following two