Multiple Choice

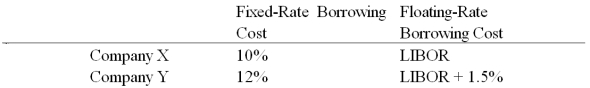

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below:  A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90%. What is the value of this swap to company X?

A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90%. What is the value of this swap to company X?

A) Company X will lose money on the deal.

B) Company X will save 25 basis points per year on $10,000,000 = $25,000 per year.

C) Company X will only break even on the deal.

D) Company X will save 5 basis points per year on $10,000,000 = $5,000 per year.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: A swap bank has identified two companies

Q28: Show how your proposed swap would work

Q30: A major risk faced by a swap

Q38: In the swap market, which position potentially

Q60: Explain how this opportunity affects which swap

Q89: Which combination of the following statements is

Q93: With regard to a swap bank acting

Q95: Company X wants to borrow $10,000,000 floating

Q97: Company X wants to borrow $10,000,000 floating

Q98: Suppose that you are a swap bank