Multiple Choice

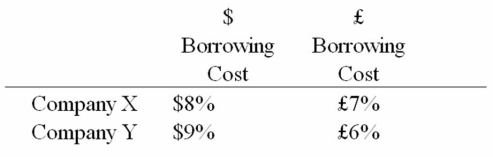

Company X wants to borrow $10,000,000 floating for 1 year; company Y wants to borrow £5,000,000 fixed for 1 year.The spot exchange rate is $2 = £1 and IRP calculates the one-year forward rate as $2.00*(1.08) /£1.00*(1.06) = $2.0377/£1.Their external borrowing opportunities are:

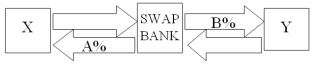

A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap.In order for X and Y to be interested,they can face no exchange rate risk

What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

A) A = £7%; B = $9%.

B) A = $8%; B = £6%.

C) A = $7%; B = £7%.

D) A = $8%; B = £8%.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: A swap bank has identified two companies

Q28: Show how your proposed swap would work

Q30: A major risk faced by a swap

Q38: In the swap market, which position potentially

Q60: Explain how this opportunity affects which swap

Q90: Explain how this opportunity affects which swap

Q93: With regard to a swap bank acting

Q94: Company X wants to borrow $10,000,000 floating

Q97: Company X wants to borrow $10,000,000 floating

Q98: Suppose that you are a swap bank