Multiple Choice

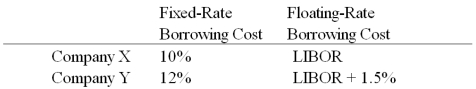

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below:  A swap bank proposes the following interest only swap: Y will pay the swap bank annual payments on $10,000,000 with a fixed rate of 9.90%.In exchange the swap bank will pay to company Y interest payments on $10,000,000 at LIBOR - 0.15%; What is the value of this swap to company Y?

A swap bank proposes the following interest only swap: Y will pay the swap bank annual payments on $10,000,000 with a fixed rate of 9.90%.In exchange the swap bank will pay to company Y interest payments on $10,000,000 at LIBOR - 0.15%; What is the value of this swap to company Y?

A) Company Y will save 15 basis points per year on $10,000,000 = $15,000 per year.

B) Company Y will save 45 basis points per year on $10,000,000 = $45,000 per year.

C) Company Y will save 5 basis points per year on $10,000,000 = $5,000 per year.

D) Company Y will only break even on the deal.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Amortizing currency swaps<br>A)the debt service exchanges decrease

Q63: An interest-only currency swap has a remaining

Q71: A is a U.S.-based MNC with AAA

Q72: With regard to a swap bank acting

Q73: Which combination of the following represent the

Q74: Company X wants to borrow $10,000,000 for

Q75: Compute the payments due in the FIRST

Q75: Explain how firm A could use the

Q78: Suppose ABC Investment Banker,Ltd.is quoting swap rates

Q90: Explain how this opportunity affects which swap