Multiple Choice

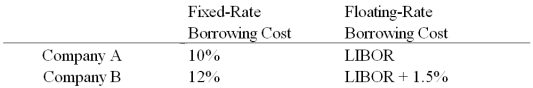

Compute the payments due in the FIRST year on a three-year AMORTIZING swap from company B to company A) Company A and company B both want to borrow £1,000,000 for three years.A wants to borrow floating and B wants to borrow fixed.A and B agree to split the QSD.

A) B pays £402,114.80 to A

B) B pays £100,000 to A

C) B pays £69,788.52 to A

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Amortizing currency swaps<br>A)the debt service exchanges decrease

Q56: FOR YOUR SWAP (the one you have

Q63: An interest-only currency swap has a remaining

Q71: A is a U.S.-based MNC with AAA

Q72: With regard to a swap bank acting

Q73: Which combination of the following represent the

Q74: Company X wants to borrow $10,000,000 for

Q75: Explain how firm A could use the

Q76: Company X wants to borrow $10,000,000 floating

Q78: Suppose ABC Investment Banker,Ltd.is quoting swap rates