Multiple Choice

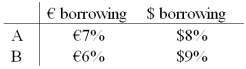

A is a U.S.-based MNC with AAA credit; B is an Italian firm with AAA credit.Firm A wants to borrow €1,000,000 for one year and B wants to borrow $2,000,000 for one year.The spot exchange rate is $2.00 = €1.00,a swap bank makes the following quotes for 1-year swaps and AAA-rated firms against USD LIBOR:  The firm's external borrowing opportunities are:

The firm's external borrowing opportunities are:

A) Firm A does 2 swaps with the swap bank, $ at bid and € at ask.Firm B does 2 swaps with the swap bank, $ at ask and € at bid.Firms A and B would each save 90bp and the swap bank would earn 20bp.

B) There is no mutually beneficial swap at these prices.

C) Firm A does 2 swaps with the swap bank, $ at ask and € at bid.Firm B does 2 swaps with the swap bank, $ at bid and € at ask.Firms A and B would each save 90bp and the swap bank would earn 20bp.

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q2: What would be the interest rate?

Q2: What would be the interest rate?

Q56: FOR YOUR SWAP (the one you have

Q66: Company X wants to borrow $10,000,000 floating

Q72: With regard to a swap bank acting

Q73: Which combination of the following represent the

Q74: Company X wants to borrow $10,000,000 for

Q75: Compute the payments due in the FIRST

Q76: Company X wants to borrow $10,000,000 floating

Q98: In the problem just previous, company X<br>A)is