Multiple Choice

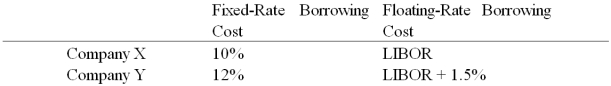

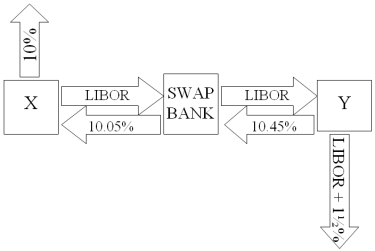

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below:  A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05%-10.45% against LIBOR flat. Assume both X and Y agree to the swap bank's terms.

A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05%-10.45% against LIBOR flat. Assume both X and Y agree to the swap bank's terms.

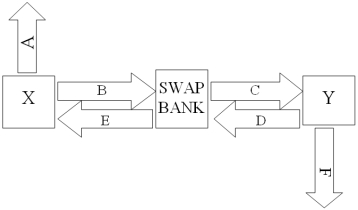

Fill in the values for A,B,C,D,E,& F on the diagram.

A) A = LIBOR; B = 10.45%; C =10.05%; D = LIBOR; E = LIBOR; F = 12%

B) A = 10%; B = 10.45%; C =10.05%; D = LIBOR; E = LIBOR; F = LIBOR + 1½%

C) A = 10%; B = 10.45%; C = LIBOR; D = LIBOR; E = 10.05%; F = LIBOR + 1½%

D) A = 10%; B = LIBOR; C = LIBOR; D = 10.45%; E = 10.05%; F = LIBOR + 1½%

Correct Answer:

Verified

Correct Answer:

Verified

Q2: What would be the interest rate?

Q36: When a swap bank serves as a

Q36: Devise a direct swap for A and

Q37: Use the following information to calculate the

Q42: A major risk faced by a swap

Q43: Company X wants to borrow $10,000,000 floating

Q44: Suppose that you are a swap bank

Q80: Swaps are said to offer market completeness<br>A)This

Q84: Explain how firm B could use the

Q99: Consider bank that has entered into a