Multiple Choice

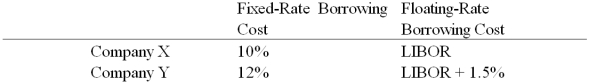

Company X wants to borrow $10,000,000 floating for 5 years.Company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are:  Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for A = Company X's external borrowing rate

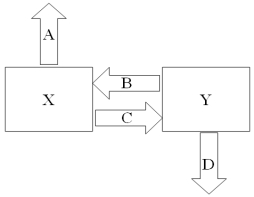

Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for A = Company X's external borrowing rate

B = Company Y's payment to X (rate)

C = Company X's payment to Y (rate)

D = Company Y's external borrowing rate

A) A = 10%; B = 11.75%; C = LIBOR - .25%; D = LIBOR + 1.5%

B) A = 10%; B = 10%; C = LIBOR - .25%; D = LIBOR + 1.5%

C) A = LIBOR; B = 10%; C = LIBOR - .25%; D = 12%

D) A = LIBOR; B = LIBOR; C = LIBOR - .25%; D = 12%

Correct Answer:

Verified

Correct Answer:

Verified

Q2: What would be the interest rate?

Q36: When a swap bank serves as a

Q41: Company X wants to borrow $10,000,000 floating

Q42: A major risk faced by a swap

Q44: Suppose that you are a swap bank

Q47: Come up with a swap (exchange of

Q80: Swaps are said to offer market completeness<br>A)This

Q84: Explain how firm B could use the

Q87: Consider a plain vanilla interest rate swap.

Q99: Consider bank that has entered into a