Multiple Choice

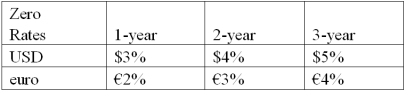

Suppose that you are a swap bank and you notice that interest rates on zero coupon bonds are as shown.Develop the 3-year bid price of a euro swap quoted against flat USD LIBOR.  In other words,what will you be willing to pay in euro against receiving USD LIBOR?

In other words,what will you be willing to pay in euro against receiving USD LIBOR?

A) 5%

B) 4%

C) 3%

D) 2%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: What would be the interest rate?

Q41: Company X wants to borrow $10,000,000 floating

Q42: A major risk faced by a swap

Q43: Company X wants to borrow $10,000,000 floating

Q47: Come up with a swap (exchange of

Q49: Devise a direct swap for A and

Q80: Swaps are said to offer market completeness<br>A)This

Q84: Explain how firm B could use the

Q87: Consider a plain vanilla interest rate swap.

Q99: Consider bank that has entered into a